An interesting trade-related trend has taken hold in the months since the United States imposed new tariffs on imports from Canada, namely a surge in trade with other countries with which Canada has free trade agreements (FTAs) in place.

According to Reuters, trade between Canada and the United Kingdom increased by more than 300% during the May 2024-May 2025 period, while trade with Singapore grew by 204%, trade with Italy by 103%, and with the Netherlands by 88%. These impressive rates of growth would seem to indicate that Canadian businesses are realizing that when it comes to duty-free trade, they have options.

Integral to those options are the 15 free trade agreements that Canada currently has in place that open doors to more than 1.5 billion consumers located across 50 partner countries. Each of the countries listed above is a FTA partner, and while the specifics of each agreement vary, benefits typically include tariff relief, customs facilitation, and industry-specific incentives to promote cross-border trade.

Although Canada’s trade agreements have been in place for years, they seem to have gained prominence as businesses look to mitigate the impact of the U.S. tariff increases. But as businesses realize the tremendous opportunities available through FTAs, including the flexibility to enlist new suppliers and expand to additional markets, “FTA optimization” may well become a permanent fixture in long-term growth strategies.

Key takeaways

Canada’s Free Trade Agreements

Canada’s 15 trade agreements include 11 bilateral agreements and 4 multi-party agreements. Three of the multi-party agreements, informally called “the Big 3,” account for almost 80% of Canada’s total trade in goods. Those agreements include:

Canada-United States-Mexico Agreement (CUSMA)

The CUSMA has been in force since 2020 and replaced/upgraded the North American Free Trade Agreement (NAFTA) which set the terms for trade between the U.S., Canada, and Mexico from 1994-2020. Decades of free trade have resulted in deeply intertwined trade relationships, with the U.S. and Canada serving as each other’s largest trading partner. According to Export Development Canada, total U.S./Canada trade during 2023 exceeded C$1.3 trillion, with C$3.5 billion worth of goods and services crossing the border each day.

[Note: The CUSMA is referred to as the United States-Mexico-Canada Agreement (USMCA) in the United States.]

Questions about the CUSMA? We have the answers! Learn more

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

This agreement establishes a trade bloc that includes 510 million consumers located across 12 countries including Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam and the United Kingdom. Together, these countries represent 15.6% of global GDP. Export Development Canada refers to Japan’s participation as a “jewel” of the agreement, since it is the world’s fourth-largest economy.

Learn more about the CPTPP. Read our overview.

Canada-European Union Comprehensive Economic and Trade Agreement (CETA).

CETA is a free trade agreement between Canada and European Union (EU) countries including Austria, Croatia, Czechia, Denmark, Estonia, Finland, Germany, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Romania, Slovakia, Spain, Sweden. Additional participants that have yet to ratify the agreement include Belgium, Bulgaria, Cyprus, France, Greece, Hungary, Italy, Ireland, Poland, and Slovenia. When fully implemented, the agreement will provide Canadian businesses with access to 450 million consumers throughout the EU, accounting for one-sixth of the global economy.

Learn how Purolator facilitates the Canadian import process . Discover now.

A fourth multi-lateral agreement, the Canada-European Free Trade Association (EFTA) applies to goods moving between Canada, Iceland, Liechtenstein, Norway, and Sweden

Beyond these multi-party, regional agreements, Canada has separate FTAs in force with Chile, Colombia, Costa Rica, Honduras, Israel, Jordan, Panama, Peru, South Korea, Ukraine, and the United Kingdom.

Benefits of FTAs

Canada’s Trade Commissioner Service provides a list of FTA benefits which includes:

Lower costs: Since FTAs generally allow for reduced or eliminated tariffs, businesses can price goods more competitively in international markets. Businesses can also obtain parts and components from international suppliers without the added cost of customs tariffs.

Access to new consumers: Reduced trade barriers allow businesses direct access to new customer bases – including foreign government procurement opportunities. Canada’s 15 FTAs provide access to more than 1.5 billion consumers, representing more than 60% of global gross domestic product (GDP).

Competitive advantage: Countries with FTAs prioritize partner companies, providing exporters with a competitive edge and increasing the likelihood of success in these markets.

Reduced risk: FTAs include standardized language regarding rules and regulations that make engagement in foreign markets more predictable and accessible.

Fewer barriers: FTAs often reduce customs-related barriers and help facilitate the customs clearance process, which allows products to enter markets faster and easier.

Access to supply chains: Businesses can expand their supplier and sourcing networks to include partners located in countries that were previously cost-prohibitive, or subject to onerous trade barriers.

Diversified trade: Businesses can add resilience to their operations by reducing reliance on a single market.

Procurement opportunities: Businesses gain opportunities to bid on certain government procurement contracts in FTA partner countries.

Avoidance of 2025 U.S. Tariffs on Canadian Imports

Another important FTA benefit became apparent during 2025, when the U.S. government announced that CUSMA-eligible products would be exempt from a series of tariffs that had been imposed on Canadian goods entering the United States. The tariffs, which were initially announced in February 2025 included, with few exemptions, a 25% across-the-board tariff (an amount that is set to increase to 35%). A few weeks later though, the Trump Administration exempted goods that qualify for benefits under the USMCA.

This set off a scramble among Canadian businesses to confirm their products met CUSMA eligibility requirements. As it turns out, only about 40% of Canadian goods entering the United States apply for benefits under the CUSMA. Instead, goods enter duty-free by relying on other trade programs that allow businesses to avoid CUSMA compliance and documentation requirements.

According to Arent Fox Schiff international law firm, more than US$406 billion worth of imports from Canada and Mexico entered the U.S. under the CUSMA during 2024. But, US$509.7 billion in imports from those countries did not claim the CUSMA preference.

Now though, CUSMA eligibility is the only avenue available to Canadian businesses looking to export duty-free to the United States. And the results have been impressive. According to the Royal Bank of Canada (RBC), almost 90% of Canadian exports accessed the U.S. market duty free in April. The reason? Increased utilization of the CUSMA.

As Livingston International trade expert Jill Hurley explained in a recent webinar, CUSMA eligibility “becomes even more critical now than it has been in the past.”

Don’t Forget About an International Logistics Strategy!

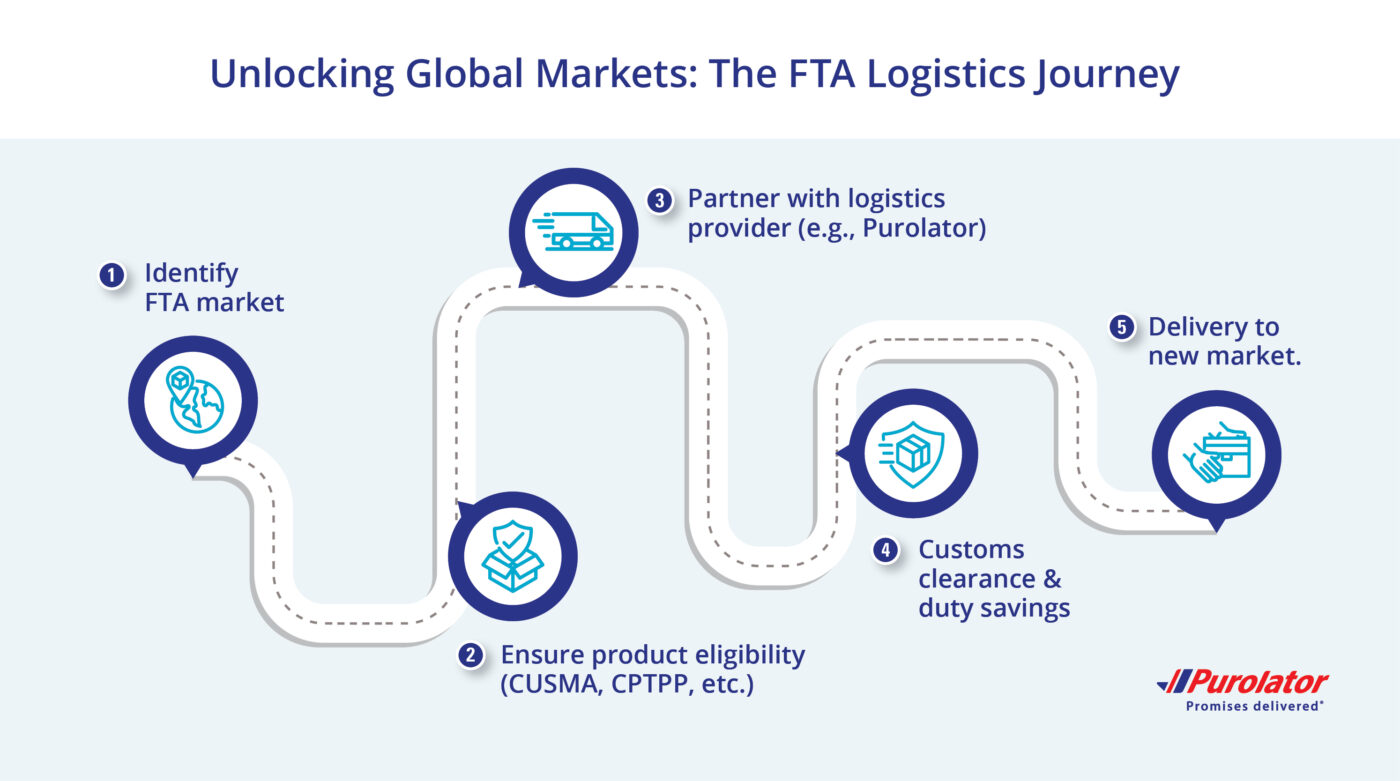

As important as market access and tariffs savings offered through an FTA certainly are, so too is the need for an efficient logistics strategy. Afterall, what good is duty-free access to a market if you don’t have a way to reach those new customers, or ensure on-time deliveries?

Too often, businesses take a “get the deal first and the logistics will follow” approach, assuming they will find a suitable logistics provider after they lock in a sale. But treating logistics as an afterthought usually backfires, with common outcomes including excessive costs, subpar service, and disappointed customers.

So, it’s imperative to include good logistics planning when considering entering an international market. A critical first step, naturally, is to identify a provider that offers coverage within the affected markets. Not just coverage, but solutions that ensure shipments arrive as efficiently and cost-effectively as possible. A business will want to identify a logistics partner that will listen to its specific needs and draw from its resources to build an ideal start-to-finish plan.

Know your tariff costs with the Purolator Trade Assistant . Use the PTA online tool.

For many businesses, Purolator is the preferred choice for global shipping needs. That’s because Purolator can offer guaranteed* service to just about any location in the world. Businesses that have long relied on Purolator for seamless service within the United States and Canada can expect the same high levels of service and efficiency as they enter overseas markets. A few Purolator capabilities include:

Global coverage

Global coverage

Purolator maintains a worldwide distribution network that offers service to more than 220 countries and territories. This includes multiple hub facilities that serve as regional points of origins. Current locations include:

- Mainland China (20+ origins)

- Hong Kong

- Ho Chi Minh, Vietnam

- New Delhi, India

- London, United Kingdom

- Amsterdam, Netherlands

- Warsaw, Poland

Purolator’s regional trade specialists work with each business to identify precise shipping needs and pinpoint the most efficient logistics solution.

Extensive service offerings

Extensive service offerings

Purolator offers an extensive portfolio of service options that accommodate each shipper’s unique needs, which ensures shipments arrive to/from their international destination when needed, at the appropriate service level.

Seamless integration into Purolator’s U.S. or Canadian distribution network

Seamless integration into Purolator’s U.S. or Canadian distribution network

Upon arrival in North America, shipments remain in Purolator’s network for final delivery throughout Canada and the United States.

Customs expertise

Customs expertise

In February 2025 Purolator acquired Livingston International, a leading trade management firm. Livingston’s team of trade specialists have specialized knowledge about each country’s customs and regulatory requirements, and insight into current economic and geopolitical conditions. Trade specialists offer a range of services including consulting and planning, brokerage services, customs optimization, and business management.

In addition, an internal team of Purolator trade specialists review each shipper’s specific customs-related requirements and ensure all documentation is completed and transmitted to the appropriate customs agency. Specialists also identify opportunities to facilitate compliance and reduce duty obligations, including FTAeligibility.

Canada’s FTAs offer opportunities and certainty, at a time of deep uncertainty

As U.S. and Canadian leaders continue to negotiate the next phase of the two countries’ trade relationship, it seems likely that the road is going to include a few bumps, at least for the foreseeable future. As Canadian businesses look to minimize the fallout, the country’s 15 FTAs may offer some relief, along with opportunities to build long-term relationships with suppliers and customers located in untapped markets.

But integral to any international expansion, must be a solid plan for ensuring logistics efficiency across global markets. This means a logistics partner that instills confidence that shipments will seamlessly move across international borders, and arrive on time, every time. Purolator offers that confidence, and is the preferred choice for businesses looking to expand to new markets.