Michelle KraskaSenior Manager, Corporate Accounting, Purolator

Michelle Kraska is the Senior Manager of Corporate Accounting (CPA, CMA) at Purolator. She oversees the Corporate Accounting team and leads the month-end close process, records the company’s finances, ensures financial compliance, and conducts quarterly audits. This includes consolidating the financials of subsidiary entities and ensuring accurate numbers to support strategic decision-making. She has also worked with individuals and small businesses to develop tax strategies, including tools and tips for tax season preparation and how to maintain organized financial books.

Being a small business owner comes with its own rewards like independence and creative ownership, but it also means you’re responsible for your taxes. While small business taxes come with their own nuances and structure, it doesn’t mean it has to be a burden. There are many ways you can lower your taxes and prepare for the future so that when tax season hits, you’re not surprised. The added benefit is that these strategies can also help heighten the financial readiness of your business.

In this Purolator Power Talk, Michelle Kraska, Senior Manager of Corporate Accounting at Purolator Inc. covers tax tips for small businesses, including how to reduce your tax burden, tax breaks to take advantage of, planning strategies, and how to build a strong financial foundation for business growth.

Learn how to effectively tackle your taxes as a small business. Check out the Purolator Power Talks podcast

Key Takeaways:

- How does your business structure affect your taxes?

- How can a small business reduce its taxes?

- 4 key tax planning strategies for small businesses

- Why is bookkeeping essential for small businesses

- Advice for managing taxes

How does your business structure affect your taxes? [0:40]

“Taxes do not need to be a source of stress,” says Kraska. “It’s an essential part of running any business large or small and creates the foundation to make the proper strategic decisions that aid your growth.”

Kraska emphasizes that no matter what stage your company may be in, your type of business is a key factor in determining the taxes you pay. Here are the 3 most common business structures and their associated tax benefits.

1. Sole proprietorship:

Run by one person, where the business revenue and expenses are taxed on a personal level. If your business has a larger profit, it will impact your income bracket and you’ll be taxed higher. The lack of separation between the business owner and business means that you hold all responsibility for business debts or lawsuits.

Tax Benefits of a Sole Proprietorship:

With a simpler structure, your taxes are easier to manage. Since you are considered a single entity, any losses can be used towards your personal income and can bring down your tax burden.

2. Partnership:

Generally, a partnership is two or more individuals or corporations that share all aspects of the business including profits, liabilities, and debts. Common examples of partnerships include law firms and co-owned businesses. The three subtypes of partnerships are:

- General partnership (GP)

A general partnership is most common and involves at least two business owners. A written agreement dictates how profit, liabilities, and debts are distributed among the owners. If there is no agreement, they are distributed equally. In a general partnership there is no protection from liability.

- Limited partnership (LP)

A type of general partnership where there is a general partner with unlimited liability and sole responsibility of company management, who is supported by two or more partners with limited liabilities contingent on their capital contributions.

- Limited liability partnership (LLP)

Limited to professional services that require a license for operation such as law firms and architect firms. In this type, all partners help manage the business and have limited liability.

Tax Benefits of a Partnership:

As a partnership, the business is not an entity which means profits are flowed through the individual partners and any losses can be put towards your personal income to lower your taxes.

3. Corporations

Where the business and the owner are two distinct legal entities with their own assets and debts. In this situation, the owner does not have complete liability over the corporation and the business can exist once the owner has passed away or leaves.

Tax Benefits of a Corporation:

Corporations are a great tax strategy because of the limited liability between the owner and business. As separate legal entities, this means this type of business has a different tax structure and has its own unique deductions and strategies available, and widened access to grants.

When should a small business incorporate?If you’re a business offering more than just consultant or freelancing services, intend to hire employees, and predict business expansion that will generate more revenue than you need, then you may want it’s likely a good idea to incorporate. This can be an effective strategy depending on your business stage and long term goals, and Incorporation can also offer some protection from financial and legal risks. Here are some considerations to keep in mind before you incorporate.

Pros:

- Limited personal liability

- Supports financing and longevity of business

- Increased credibility

- Widened access to grants and capital

- Decreased tax rate

- Additional paperwork

- Costly to incorporate

- Associated ongoing costs

- Financial losses can’t be used to reduce taxes

How can a small business reduce their taxes? [5:13]

According to a recent survey, only 48% of small business owners feel confident they’re correctly paying their taxes. This means that nearly half of small business owners may be paying more than they have to, and may be unaware of applicable write-offs. “Some of the ways that taxes can be alleviated from the businesses is strategizing,” says Kraska. “This includes making use of the deductions for your specific business type.”

Here are Kraska’s top 8 ways to alleviate your tax burden as a small business in Canada.

1. File on time

For small businesses, the tax filing deadline in Canada is June 15 (or June 16 if the 15th falls on Sunday). Any money owed must be paid by April 30, or you will be faced with a penalty of 5% with an additional 1% every month. As a small business, it’s important to file before April 30 or by the earliest filing date of February 24 to reduce any unnecessary tax expenses.

Consult the Canadian Revenue Agency’s Personal Income Tax Page for the most accurate information on deadlines,

2. Incorporate your business

If it makes sense for you to incorporate your business, you can take advantage of unique tax deductions. For example, corporations with an income less than 500K are subject to the small business deduction which is a lesser tax rate.

3. Use of the tax deferral method (if incorporated)

Another strategy for corporations is the tax deferral method. “Because corporate tax rates are lower than personal tax rates, if you withdraw all the funds from your corporation, you’ll be taxed at a higher tax rate,” says Kraska. “If you don’t need those funds on a personal level, you can keep them in your corporation and push them for another time. The corporate tax level is lower, so you’ll have a lower corporate tax rate for that year until you withdraw those funds.”

4. Employ your family members

“If you have family members working with you in your corporation, you can utilize income splitting,” says Kraska. This strategy allows you to shift income from higher tax brackets to family members within lower ones. By doing so, you can alleviate your tax burden. You can also deduct their wages as a business expense.

5. Claim any expenses and deductions

As a small business, you can deduct costs incurred by your business to help lower your taxable income. Throughout the year, keep clear and detailed records of all business transactions which should include expenses and their receipts, income, and invoices.

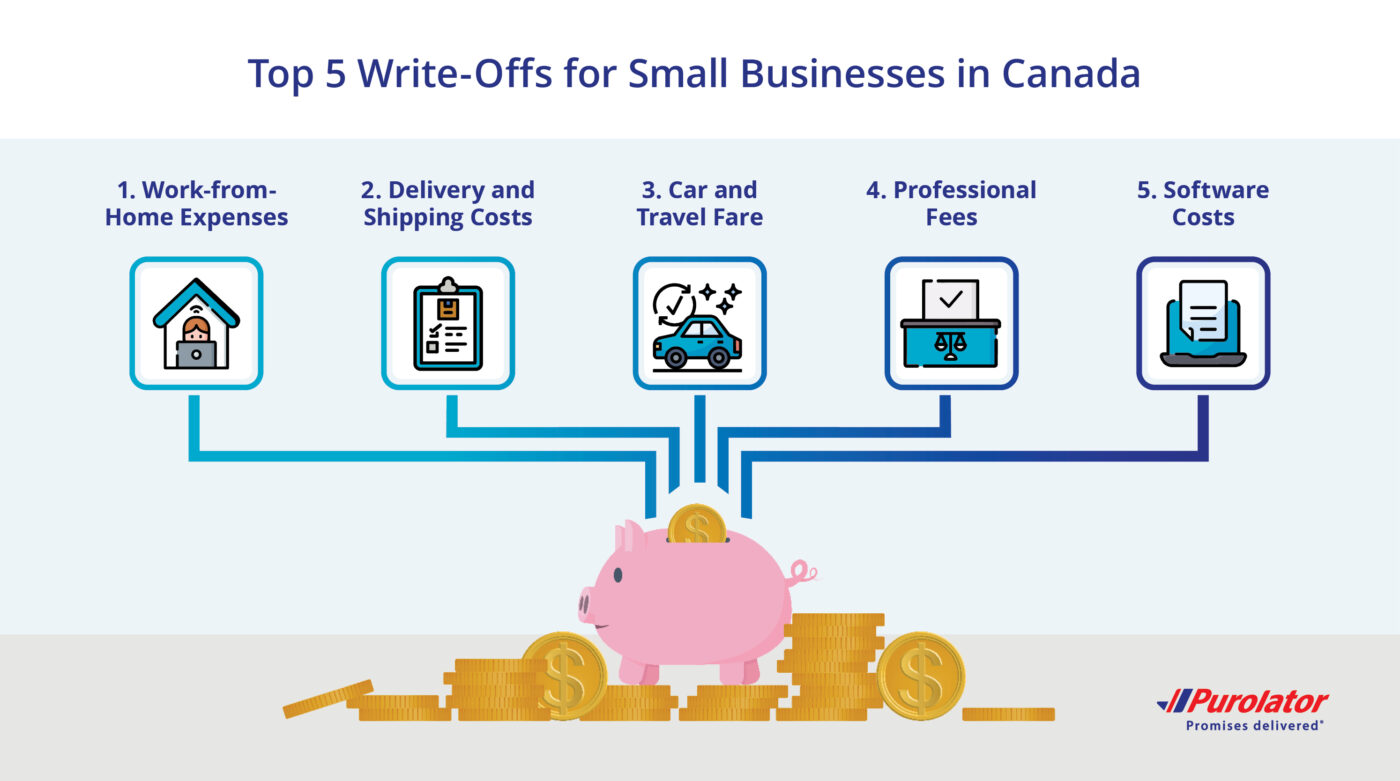

Here are top 5 write-offs for small businesses in Canada, according to Kraska.

1. Work-from-home expenses

- This includes rent, internet, utilities, mortgage interest, insurance and more. The amount expensed is proportional to the square footage of your working space to the square footage of your living space.

2. Delivery and shipping costs

- If you are incurring any delivery, freight, and express costs during your business operations, you can expense these shipping costs.

3. Car and travel fare

- If your work requires you to travel and this generates business, you can deduct these costs from your taxes. This includes car maintenance, gas, and airline, bus or train tickets.

4. Professional fees

- If you are required to pay annual dues as part of your profession, you can deduct and claim these fees as part of your business expenses.

5. Software costs

- This includes any software used as you conduct your business such as Adobe, Microsoft, and Turbotax.

For a full list of write-offs, consult the Canadian Revenue Agency’s business expenses list here.

6. Use losses to reduce tax burden

6. Use losses to reduce tax burden

As previously mentioned, if your business is a sole proprietorship or partnership, you can put any losses towards your personal income to lower your taxes. This is also called carrying capital losses backward or forward. If you have incurred any capital losses, you can use this to offset any gains so you can lower your income and reduce your taxes. For more information, see the Canadian Revenue Agency’s Capital Losses page.

7. Contribute to your RRSP to maximize your tax break

Kraska stresses the importance of making the most of your RRSP (Registered Retirement Savings Plan) and investments as a small business. “If you’re able to contribute to your RRSP account throughout the year to minimize your taxable income at the end of the year, that is beneficial in the long run.”

Kraska also recommends taking your RRSPs and using them to invest so your funds grow. For example, if you choose to use your RRSPs to invest in stocks and withdraw the funds after maturity, there won’t be any penalization so long as the funds stay as an RRSP until retirement. Otherwise, you will pay taxes upon early withdrawal.

8. Claim federal tax credits like the Canadian Carbon Rebate

If you are a Canadian-controlled private corporation and you are integrating environmental sustainability into your small business, you may be eligible for the Canadian Carbon Rebate. There are several other federal tax credits available for small businesses which can vary depending on your industry. See the full list here.

4 key tax planning strategies for small businesses [9:36]

To prevent scrambling at the last minute and facing any unexpected surprises, Kraska emphasizes the importance of understanding the finances before tax season begins. Here are her 4 tips for planning ahead.

1. Understand your financial landscape

For Kraska, one of the most important steps for small businesses is understanding your finances, which include your gains and losses. With this information, you can determine how much to pay yourself, how much should be retained within the business, and what your tax burden will be.

2. Set up a quarterly check-up

Kraska recommends that small businesses should set up a quarterly financial checkup. This includes an overview of your profits, which lets you make any necessary adjustments and calculate your taxes for that point in time.

3. Understand when you need to charge GST

As a small business, if your revenue exceeds 30K within a single calendar year or four consecutive quarters, you are required to collect, file, and remit GST. If you are still growing your small business, quarterly check-ins can not only keep you prepared for end of year taxes, but it can also give you visibility for when you should begin charging GST. For more information, see the CRA’s GST/HST page for small businesses.

4. Open up a separate bank account for taxes

This is Kraska’s top tip for clients who are feeling overwhelmed and express concern over not having enough funds for taxes. “Open up a separate bank account, so as you do your quarterly check-ins with your business, you can calculate and know how much your tax burden is on the corporate side, personal side, GST side, and put those funds away. That way when tax season comes and you’re finally required to pay, you’re not surprised.”

Why is bookkeeping essential for small businesses? [12:32]

Kraska stresses that for small businesses in Canada, bookkeeping is an important part of taxes. As an organized financial record of your company, your books provide a foundation for clarity, legal and CRA compliance, decision-making and more. There are two methods small businesses can use for bookkeeping:

1. Personal bookkeeping

Ideal for sole proprietorship or fledgling small businesses or partnerships. Gives full visibility and is a cheaper method for companies just starting out.

2. Outsourced bookkeeping

Ideal for business owners with limited time or who aren’t comfortable bookkeeping themselves. If you are unsure and don’t want to make mistakes, you may want to opt for this method.

According to Kraska, both methods are great for their own reasons, especially considering the stage of your business. In a recent report released by the Certified Professional Bookkeepers of Canada, only 42% of Canadian bookkeepers affirming that small businesses are likely to hire bookkeeping professionals.

Having organized books can also help eliminate risks when it comes to audits, and can help grow your company. “A complete record of your business’s finances, fully recorded and balanced, can help with investing and financing,” says Kraska. “All investors will want to see your books. So by having an organized record, it’ll make for a smoother conversation.

Advice for managing taxes [14:41]

As a small business, you’re typically wearing many hats, which means taxes can quickly feel overwhelming. However, Kraska emphasizes that alleviating that stress comes down to knowledge and preparedness. This includes understanding the finances of your business, gathering the information to plan ahead, and evaluating what tax strategies are available to you.

There are many ways to get small business tax help for free through your city, province, or federally via the CRA’s free tax clinics or their Liaison Officer service.

Tackling your taxes with confidence as a small business

With the right knowledge, resources, and strategies, taxes don’t have to be a source of anxiety for small business owners. Community is an important part of small business success, and for Kraska, it’s an excellent resource if you’re feeling unsure with your taxes. “We all had to start somewhere,” says Kraska. “Reach out to your colleagues or a professional. Without asking those questions, we wouldn’t be where we are today with the foundations that we now have.”

At Purolator, we understand the importance of having the right resources and support. We are committed to championing small businesses in Canada, including initiatives focused on building community, and facilitating growth through opportunities like the Purolator True North Small Business Grant Contest.

Looking for more small business tips? Explore our resources for small businesses.