On the one hand, U.S. President Donald Trump said he had “a lot of respect” for Canadian Prime Minister Mark Carney when the two leaders met on May 6 in the White House Oval Office. Trump also called the United States-Mexico-Canada Agreement (USMCA) a “good deal for everyone,” sparking cautious optimism for a smooth reset of the countries’ strained trade relationship. But when a reporter asked if there was anything the prime minister could say to avoid tariffs, President Trump responded with a simple “No,” before adding “that’s the way it is.”

In the aftermath of the two leaders’ meeting, the only certainty seems to be that no end to the current trade tensions seems imminent. U.S. and Canadian businesses hoping for relief from the roller coaster of tariffs, retaliatory surcharges, and escalating rhetoric will have to wait a bit longer.

But that doesn’t mean businesses can’t seek out opportunities to minimize the effects of the trade war on their internal operations, including their supply chains. From double-checking tariff classifications and product valuations, to tweaking product attributes, to storing products in “foreign trade zones,” shippers have options that may help mitigate the impact of the heightened tariffs.

“Options are available”, Jill Hurley, senior director of global trade services at Livingston International explained in a recent blog post, but “there’s no panacea; no universal solution.” Instead, she continued, “each business will have to determine how best to cope with the tariffs based on its supply chain configuration and end markets.”

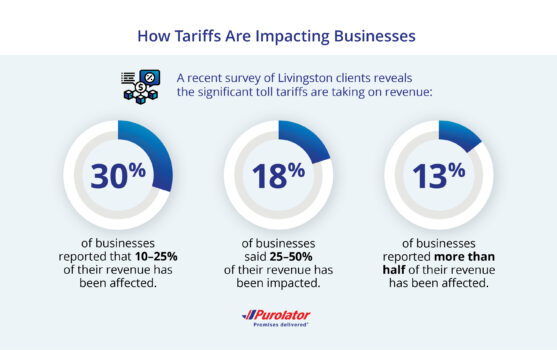

Hurley, along with Livingston colleague Jeff Fraser recently joined Purolator colleagues for a series of webinars in which they detailed several duty mitigation strategies available to U.S. and Canadian businesses. An early-April survey of Livingston clients found the tariff increases have already started to take a toll. A few findings include:

- Almost 30% said that 10-25% of their revenue has been affected by the tariffs.

- 18% said between 25-50% of their revenue has been affected.

- 13% reported more than half of their revenue has been affected.

In case you missed it – get caught up on all tariff issues by watching our three new Livingston International/Purolator webinars:

- Part One – Navigating U.S.-Canada Trade: How Tariffs Are Reshaping Cross-Border Business (focus on U.S. tariffs)

- Part Two -- Navigating U.S.-Canada Trade: How Tariffs Are Reshaping Cross-Border Business (focus on Canadian retaliatory actions)

- 2025 Tariffs: Dealing With Disruption (updated overview of U.S. and Canadian actions)

Before delving into some of the tariff-relief options, following is a brief recap of U.S. and Canadian trade actions in effect as of mid-May:

Goods entering the United States

- 25% tariff on steel and aluminum.

- 10% tariff on energy and energy resources products, including potash, if not eligible under the USMCA.

- 25% tariff on products originating in Canada and Mexico that are not eligible under the USMCA.

- 25% tariff on imported autos. This includes a 25% tariff on imported auto parts.

In addition, planned or proposed changes include:

- Possible elimination of the de minimis exemption, which allows shipments valued at less than $800 to avoid duties and formal entry requirements. The de minimis exemption has already come under scrutiny for shipments originating in China and Hong Kong. In early May, the duty-free exemption was eliminated, and replaced with a new 120% tariff. However, a mid-May agreement between the U.S. and China saw that rate reduced to 54%. The 54% tariff rate is scheduled to remain in effect for 90 days.

- Possible “extra 25%” tariff on copper and lumber.

- Possible 25% tariff on semiconductors and pharmaceutical products.

- Proposed tariff action on movies made outside of the United States, including in Canada.

U.S. goods entering Canada

- 25% tariff on goods valued at US$30 billion. List of affected products includes orange juice, peanut butter, wine, appliances, apparel, footwear, cosmetics and certain paper products.

- 25% retaliatory tariff on U.S. steel and aluminum products, and on products including tools, computers, display monitors, and sports equipment.

- 25% tariff on non-USMCA compliant vehicles imported into Canada from the U.S.

Potential future tariff increases

- A subsequent package of retaliatory tariffs was suspended after President Trump announced a pause on certain duties. The suspended tariffs would have affected US$87 billion in U.S. goods including electric vehicles, fruits and vegetables, dairy, beef, and pork, among other targeted products.

The tariff increases are significant, and causing businesses to rethink trade strategies formerly thought to be rock solid. This includes taking a hard look at customs compliance protocols for opportunities to find relief from the new tariffs. Many businesses have been pleasantly surprised to find that things can be done, often without having to significantly overhaul their cross-border practices.

Tariff Mitigation Strategies

Following is an overview of several of the programs and practices that are helping traders reduce the effects of the current tariff increases.

Determine USMCA eligibility

According to Livingston’s Jill Hurley, the USMCA is “more valuable today than it’s ever been for exporters and importers.” That’s because goods that qualify for USMCA benefits are exempt from the recent tariff increases. This means, Hurley notes, “the USMCA is every North American importer’s ticket to mitigating the impact of the new tariffs.”

The problem though, is demonstrating eligibility for USMCA benefits can be complicated, and time consuming. As a result, many shippers opt to not even bother applying for USMCA benefits. Hurley estimates that only about 40% of Canadian exports to the U.S. apply for trade agreement benefits. Instead, businesses choose to use other tariff-reducing mechanisms or decide to pay the higher rates.

But with USMCA eligibility now integral to avoiding the new tariffs, businesses will want to rethink current practices. USMCA status is the “golden ticket” for cross-border success, and the process for determining eligibility starts with a product’s tariff classification.

Check and double-check tariff classification accuracy

Every product crossing an international border must have a tariff classification code assigned. In Canada, shippers identify the correct code from the Customs Tariff listing. In the United States, the listing is called the Harmonized Tariff Schedule. Tariff codes serve a number of purposes that include:

- Determining the applicable tariff rate.

- Determining eligibility for free trade agreement benefits.

- Identifying any import/export restrictions, among other factors.

Even in the best of circumstances, determining the correct tariff classification code can be difficult. Classification listings consist of thousands of entries, often with slight variances from one code to the next, but with vastly different tariff rates. A pair of slippers, for example, carries a duty rate between 3%-12.5%, whereas a pair of sneakers could trigger a rate as high as 37.5%.

For purposes of demonstrating USMCA eligibility, a shipper will want to review its product’s attributes to try and find a tariff classification that qualifies for benefits. Beware though, a shipper must be careful to exercise reasonable care in selecting a code that is accurate and justifiable. Any shipper determined to have acted in bad faith in its tariff classification selection will be held to account with significant penalties.

So how to identify the correct tariff code? Shippers have several tools available to help:

- Advance rulings. A shipper can ask U.S. Customs and Border Protection (CBP) or the Canada Border Services Agency (CBSA) to review a product prior to its arrival at the border and determine the correct tariff classification. This provides certainty regarding a business’s tariff obligations but, since advance rulings are binding, a business cannot dispute the customs agency’s decision.

- Prior rulings. Both the U.S. and Canadian governments make available listings of all previous advance rulings. Businesses have the option to review prior determinations for guidance in selecting a classification code.

- Trade professionals. Trade experts including professionals from Livingston International and Purolator have experience with U.S. and Canadian tariff codes and can help a business identify the correct classification.

- Tariff lookup tools. Purolator offers a “tariff lookup tool” that provides online assistance for businesses trying to identify classification code.

Product valuation

Since tariffs are assessed as a percentage of a product’s value, a business will want to ensure the value listed on customs documentation is as “bottom line” as possible. This includes reviewing all inputs to determine if anything can be eliminated, and ensuring all components have been correctly assessed.

In general, according to CBP, shipments must list the price a buyer has paid for a product (and not the amount for which it will be sold). This is called the product’s transaction value, and should also reflect money paid for commissions, assists, royalties, production costs and packaging, and these items should be included on the commercial invoice. A business should carefully review all invoices and product information to ensure the lowest value is identified. Once again though, a shipper must be careful to exercise reasonable care, and to ensure that all claims can be documented.

Free Trade Agreements

Both the U.S. and Canada have free trade agreements in place with multiple countries which, depending on a business’s supply chain, may provide low-cost sourcing alternatives.

Canada currently has 15 FTAs that provide access to 1.5 billion consumers worldwide, and more than 60% of the world’s GDP. The United States has 14 FTAs in force that affect trade with 20 countries. While the specific details of each agreement vary, FTAs offer important benefits including duty-free status for certain products, elimination of trade barriers, and incentives for designated industries.

A business suddenly faced with exorbitant tariff increases may be able to mitigate those costs by shifting sourcing to a supplier located in a country with a FTA in place. Livingston recommends that businesses examine their supply chains, and “do the math” to determine if the savings attained by moving to a low-tariff supplier are significant enough to warrant such a move.

Tariff Engineering

Have you ever heard of a nurse’s pocket? A few years ago, long before the current trade war, designers at Columbia Sportswear company realized that placing a pocket below the waistline on certain women’s garments would result in a lower rate of duty. A significant reduction – pockets above the waist would pay a rate as high as 26.9%, while pockets below the waist were assessed at a rate of 16%. The company embraced the “lower pocket” model and gave it a name – the nurse’s pocket.

This is an example of something called tariff engineering – the process of adjusting a product design to qualify for a reduced tariff rate. Another example involves Converse footwear company, which modified the soles of certain sneaker products so they would qualify as slippers under the tariff classification system. According to Clearit USA, the company “adds an extra layer of felt to the bottom of their sneakers to qualify for a lower duty rate.” This added step allows the company to pay a 3% rate of duty instead of a rate as high as 48%.

Although the use of tariff engineering can be quite lucrative, it is not without risk. In 2024 the Ford Motor Company was fined $365 million by the U.S. Department of Justice for improper tariff engineering. According to the complaint, Ford imported cargo vans from Turkey and “represented them to U.S. Customs and Border Protection with sham rear seats and other temporary features to make the vans appear to be passenger vehicles.” This allowed the company to qualify for a duty rate of 2.5%, rather than the 25% applicable to cargo vans. However, the Justice Department claimed, the rear seats were removed from the vehicles after customs clearance, and the vehicles “returned to [their] original identity as two-seat cargo van[s].”

Any business interested in exploring a tariff engineering strategy is advised to proceed with caution, and seek appropriate legal counsel and customs expertise.

Foreign Trade Zones and Customs Bonded Warehouses

Another option involves the use of a foreign trade zone (FTZ)as a way to delay tariff payments, and improve business cash flow in the process.

In the United States, FTZs are secure designated areas that, while located within U.S. borders, generally fall outside its scope of jurisdiction with regard to duty assessments and other customs entry procedures. This allows a business to delay paying duties on certain products until they enter the domestic marketplace.

According to Sandler, Travis & Rosenberg: “Goods imported into a FTZ and subject to specific operations (e.g., assembly, manufacture, processing, repackaging, repair, storage, destruction) are not subject to duty unless they leave the zone for domestic consumption….”

Depending on a business’s specific circumstance, a FTZ can offer significant benefits. According to the National Association of Free Trade Zones, key opportunities include:

- Duty deferral benefits. Instead of paying duty when a shipment crosses a border, duty payment is deferred until the goods are actually transferred from a FTZ into the local market.

- Elimination of duties. Since no duty is paid on merchandise exported from an FTZ, duty is effectively eliminated on foreign merchandise admitted to a zone that is eventually exported from an FTZ. Duties are also eliminated on merchandise that is scrapped, destroyed, or consumed in a zone.

- Reduced customs fees. In the U.S., a merchandise processing fee (MPF) is assessed on shipments valued at more than $2,500. Shipments entering a FTZ though, can delay paying the tax, and reduce total obligations.

- State and local taxes. Products held in a FTZ may qualify for exemptions from state and local tax exemptions.

- Streamlined Logistics. FTZ users can take advantage of direct delivery whereby imported goods move directly from the port of unloading to the distribution center, thereby eliminating certain customs-related delays. For companies moving products from the west coast to east coast, direct delivery can save days.

Duty Relief Program (Canada): Canada also offers access to foreign trade zone-type programs. According to GHY International, the Duties Relief Program is Canada’s primary FTZ program, with provisions similar to those available in the United States. “Through the Duties Relief Program,” the GHY analysis notes, “importers are relieved of paying duties on imported goods that are stored, processed or used in the manufacture of other products, as long as these goods are subsequently exported.”

Customs Bonded Warehouses: U.S. and Canadian businesses can also avail themselves of a customs bonded warehouse as a way to defer duty payments. A customs bonded warehouse, according to CBP, “is a building or other secured area in which imported dutiable merchandise may be stored, manipulated, or undergo manufacturing operations without payment of duty for up to five years from the date of importation.” In Canada, goods can be stored in a bonded warehouse for up to four years.

Benefits of a Customs bonded warehouse include:

- Duty deferral. Duties can be delayed, reduced, and in some instances eliminated, providing a significant boost to a business’s cash flow.

- Re-exportation opportunities. Products can be re-exported without entering the domestic market. This allows businesses streamlined and cost-efficient access to global markets.

- Inventory management. Businesses can store inventory in strategically beneficial locations without the worry of duty liabilities.

Bonded warehouses are similar to foreign trade zones, but there are differences that may make one option more advantageous.

Recent reporting by CNBC noted a “surge of companies” turning to FTZs and bonded warehouses as a way to manage tariff payments. “Any time tariffs are in the news, we see an increase in interest in programs to help U.S. companies mitigate the impact,” one trade expert said.

Choosing a tariff mitigation strategy

As this overview makes clear, shippers have options available to help to manage fallout from the current trade war. In deciding which strategy makes the most sense though, a business will need to carefully assess its unique situation and weigh the pros and cons of each option. In doing so, keep in mind a few pieces of advice offered by Livingston trade experts during the recent Livingston/Purolator webinars:

- The tariff situation is changing rapidly. Make sure you rely on trusted sources for current information. Reliable sources include customs notices and official government postings. Remember, policy is not made via “tweet” and other social media postings.

- Make sure your actions can be justified and documented. Customs agents carefully scrutinize all tariff classifications and product valuations. Shippers are expected to exercise “reasonable care,” and have documentation and justification to support their customs-related decisions.

- Flexibility is key. Sudden disruptions are best managed when a business has options to fall back on. Take advantage of mitigation strategies to make your supply chain more resilient, and better able to weather the current period of uncertainty.

Important to note, these resources extend to logistics efficiencies and savings. While cross-border shippers have understandably been focused on the changing trade environment, Purolator has continued to lead the way with innovative cross-border logistics strategies. Our logistics and brokerage experts work with each business to develop the most efficient solution possible.

Now more than ever, businesses can rely on Purolator for trusted brokerage and logistics solutions, and a sense of stability during this period of uncertainty.