U.S. medical device companies might be a little intimidated by the medical device regulatory language on Health Canada’s website which states: “Canada has one of the best regulatory systems in the world for medical devices, with some of the most stringent requirements.” In fact, Canada does impose strict medical device regulatory requirements and Health Canada, the federal agency responsible for overseeing the safety of devices sold in Canada, strengthened several mandates in the last couple of years.

But U.S. medical device companies and manufacturers with products that meet U.S. Food and Drug Administration (FDA) safety and usage requirements will find that Canada’s requirements are not dramatically different. Where the two countries mainly diverge is with regard to permits and licenses, reporting requirements, quality assurance, and procurement and distribution practices. In addition, U.S. companies must meet Canadian import regulations as enforced by the Canada Border Services Agency (CBSA).

As overwhelming as the process may seem, a U.S. business can take steps to ensure a relatively fast and seamless entry to the Canadian market. The key of course, is to understand regulatory protocols, paperwork and documentation requirements, and the importance of having a Canada-based logistics strategy.

Following are 4 tips to help guide the way:

1. Understand Canada’s Regulatory Requirements

Before any device can be sold in Canada, it must be registered, with certain products required to obtain a Medical Device License.

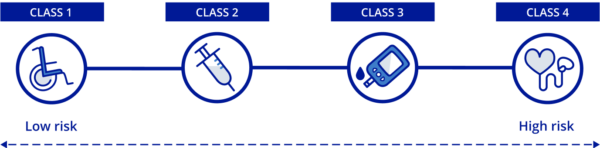

- Health Canada categorizes devices based on the risk associated with their use. Devices are categorized into four distinct classes, with Class I devices presenting the lowest risk (e.g., a thermometer or tongue depressor), and Class IV devices presenting the greatest potential risk (e.g., pacemakers).

- Manufacturers of Class II, III and IV devices must obtain a Medical Device License before they can be sold on the Canadian market.

- While Class I devices do not need a Medical Device License, they are monitored through Establishment Licenses. Class I device manufacturers, as well as importers or distributors of all device classes are required to obtain an Establishment License.

Medical devices sold in Canada must meet specific labeling requirements as required by Health Canada’s Food and Drugs Act, and Medical Devices Regulations. While many of these provisions mirror U.S. Food and Drug Administration regulations for sales within the United States, there are several that are unique to the Canadian market. A few examples include:

- Language requirements: Certain information, including labels and directions for use, must be supplied in both English and French. This is to accommodate Canada’s status as a bi-lingual country, with both English and French recognized as official languages.

- Temperature information. Temperature-sensitive devices must provide storage requirements, with temperatures listed in degrees Celsius.

Canada’s regulatory requirements were strengthened via a 3-part “Action Plan” which was phased in 2019-2021. The Action Plan increases reporting requirements, especially regarding letting Health Canada know of any reports of device malfunctions or failures. In certain situations, Health Canada may compel a manufacturer to conduct assessments, tests, or studies.

2. Understand the Canadian Healthcare System – Universal Coverage for “Medically Necessary” Services

The Canadian government describes its healthcare system as a publicly-funded system that provides “universal coverage for medically necessary healthcare services provided on the basis of need, rather than the ability to pay.”

Responsibility for the system, known as “Canadian Medicare,” is shared by the federal government and the country’s 10 provinces and 3 territories. The federal government sets overall directives, ensures safety of devices and pharmaceuticals, and provides some funding. Each province/territory offers an insurance plan, maintains a healthcare system, and delivers services. Private insurance is available to cover costs for services and products that do not fall within the scope of “medically necessary.”

There is no national definition as to what services and treatments are considered “medically necessary.” Each province and territory makes its own determination and provides required healthcare services at no cost to patients.

A direct result of Canada’s approach to health care has been the establishment of 13 unique healthcare plans, one in each of Canada’s 10 provinces and 3 territories. Each province and territory develops its own “best practices” with regard to covered services and products. These standards also extend to procurement and pricing practices, and requirements for receiving, storing and distributing medical supplies.

Currently, there is no consistent model for procurement. The rules are different in each province and are often different within regions or among specific providers. U.S. businesses should understand each entity’s procurement rules and practices before attempting to establish a relationship, a listing of which is provided by the U.S. International Trade Administration.

3. Ensure Customs Documentation Accuracy: Incomplete, Inaccurate and Missing Paperwork are the Main Reasons for Delays

Every shipment crossing the U.S.-Canada border must successfully comply with CBSA import requirements, including the need to provide precise information about the contents of that shipment. While precise requirements may vary based on shipment type, all information must be accurate and complete.

As obvious as this may seem, many shipments arrive at the border with missing or incomplete information – or information determined by customs officials to be inaccurate. CBSA advises shippers to be especially vigilant in 3 specific areas:

- Tariff Classification – Every product must include a 10-digit tariff classification number as found in the Canadian Customs Tariff product listing. Canada’s tariff classification system is based on the international Harmonized System, which is recognized by more than 200 countries worldwide, and ensures similar classification of identical products from one country to the next. This means for example, that a shipment of apples imported into Canada will have the same classification code as apples imported into any other participating country. Where it gets tricky though, is when the apples are “red delicious,” “Macintosh,” “organic,” or some other variation. Different tariff classification codes distinguish these tiny nuances, and a shipper needs to be certain they have selected the precise code that best describes its product. Making that determination can be difficult. But since tariff classification codes determine the amount of duties/tariffs that may be owed, and whether a product is eligible for free trade agreement benefits, customs agents pay close attention to the classification assigned to each shipment. Shippers can ensure accuracy in several ways including:

- By asking CBSA for an advance ruling. A shipper can ask CBSA to determine a shipment’s correct tariff classification prior to the shipment arriving at the border. This eliminates the risk of a shipment being delayed and provides certainty about tariff/duty obligations. However, CBSA’s ruling is binding, which means a shipper cannot dispute the agency’s determination.

- By reviewing CBSA’s listing of previous advance rulings. CBSA maintains a repository of all prior advance listings. Shippers can search the listing to identify similar products and decide whether that tariff classification is appropriate for their shipments.

- By using the Canada Tariff Finder, offered by the Canadian government to help shippers identify the correct classification. Shippers enter keywords that describe their products and are guided through a process until a “likely” classification number is suggested.

- By using Purolator’s Trade Assistant which guides shippers through the process of identifying the correct classification.

- Country of Origin – Every product entering Canada must list a country of origin, which refers to “the country of manufacture, production, or growth of any article of foreign origin” entering a country. In some instances, dairy and agriculture, for example, determining the country of origin can be straightforward. But for manufactured goods that include multiple components and a complicated manufacturing process, there are complex rules for determining country of origin. Since eligibility for free trade benefits and tariff rates are determined in part by a product’s country of origin, it’s important to correctly identify this piece of information.

- Valuation – Products must also be assigned a valuation that is used for several purposes, including assessing duties and collecting accurate statistics. However, determining the correct valuation can be complicated, since many factors need to be considered.- In general, the value listed on a commercial invoice should be the price a buyer has paid for a product (and not the amount for which the goods will be sold). This is called the product’s transaction value.- Sometimes though, it is not possible to assign a transaction value. In those situations, alternative processes are used, including the value of identical merchandise, or the value of similar merchandise.

Similar to assistance available for identifying a correct tariff classification code, shippers can request an advance ruling, or utilize Purolator’s Trade Assistant for help in identifying a product’s country of origin or valuation.

4. An Experienced Logistics Partner is Essential to Success

In addition to the border clearance process, and Health Canada’s strict regulatory protocols, U.S. medical device companies must have a strategy for ensuring on-time, secure deliveries to their Canadian customers. Deliveries may feature specific requirements including:

- Time-specific windows for deliveries to hospitals and surgical centres.

- Inside deliveries to medical offices, community health centres and other facilities.

- Use of specific elevators, deliveries to designated storage rooms, and other specific accommodations.

- Deliveries of time-sensitive materials to patients’ homes.

- Deliveries of daily supplies to geographically-convenient locations for quick access by home healthcare professionals.

- Deliveries throughout Canada, including to rural and remote locations. In some parts of Canada, facilities are not accessible by highway, and instead can only be serviced via air, water, or off-road vehicles.

Not every logistics company has the Canadian expertise or resources necessary to accommodate the unique needs of cross-border medical device shipping. Which is why it’s essential to carefully consider a logistics provider’s capabilities within the Canadian market.

Insist on a logistics company that prioritizes Canada, and also prioritizes healthcare-based shipments. Key features to look for include:

- Comprehensive end-to-end service. Look for a provider that offers service within the United States as well as throughout Canada. Many medical device companies entrust their shipments to a U.S. provider only to learn their shipments will be handed off to another provider once in Canada. This increases the risk of damage or theft and can add delays to sensitive or urgent deliveries.

- Broad scope of services. Choose a provider that offers a broad portfolio of service options – courier, freight, air, hybrid – that enable customized solutions for a diverse range of situations. Especially critical for device companies, look for a company that offers “mission critical” services that satisfy the need for time-definite deliveries with minimal risk of shipment damage.

- Broad geographic reach. Most Canadian logistics companies only service certain geographic areas. This often results in shippers having to enlist multiple regional providers, with shipments transferred multiple times based on ultimate destination. A better option is to enlist a logistics provider that services all of Canada. This ensures visibility, consistency of service, minimal risk of damage and theft, and is basically just a more logical approach.

- Experience with medical device shipping and delivery. Medical devices often require special handling such as extra-secure packaging, temperature-sensitive environments, and in some cases, dangerous goods handling. Choose a logistics provider that has invested in the necessary equipment and has a proven record of success in transporting medical devices. Look for healthcare-specific services that include:

- Time-definite deliveries

- Adult signature capabilities

- Chain of signature capabilities

- Special handling services for unique package sizes

- Digital Indicator that ensures healthcare shipments receive priority handling

- Mobile app capabilities

- Inside deliveries

- Dangerous goods capabilities

- Efficient, professional last mile services

- Returns management

U.S. medical device companies are important contributors to the Canadian market, accounting for roughly 45% of international devices sold in that country. Companies now have an opportunity to expand their presence, as demand for quality devices increases. Successful companies will do their homework, and understand all customs-and-regulatory related requirements, and make sure they partner with a logistics provider that has the resources to ensure success in the changing Canadian market.