Stefania BlasiSenior Director, Industrial Vertical Global Sales & Strategy, Purolator

Stefania Blasi is Purolator’s leading industrial logistics solutions expert. She leads strategic initiatives to pinpoint exactly what businesses need, helping them drive revenue growth with innovative shipping solutions. Stefania’s continual pursuit of new creative strategies has resulted in strong business partnerships among leading national and international customers within the industrial vertical.

Logistics Efficiency Offers a Steady Hand for Auto Aftermarket Cross-Border Shippers

Trade war or not, people will still need to get their oil changed. And they will need to replace worn tires, wipers, and any of the other multitudes of parts and components involved with vehicle upkeep. Chances are good at least some of those products will have to cross the U.S./Canadian border. This is at a time when a cloud of uncertainty hangs over the U.S./Canada trade relationship, and developments seem to change on an hourly basis.

Smart aftermarket businesses should take stock of their cross-border strategies and consider options for boosting efficiency. Businesses may be pleasantly surprised at the extent to which a well-managed logistics strategy can improve operations and help manage costs.

First though, it’s essential to understand the degree to which aftermarket businesses would be in the crosshairs should a U.S./Canada trade war materialize. As a subset of the highly integrated North American auto market, parts and supplies have benefited from the United States-Mexico-Canada Agreement (USMCA). Parts that meet USMCA requirements enjoy duty-free status and a simplified customs clearance process, while businesses have access to the tens of thousands of manufacturers and suppliers that have put down stakes in North America.

The automotive industry is highly integrated, which has made the ongoing discussion of tariff changes by U.S. President Donald Trump to impose 25% across-the-board tariffs on imports from Canada and Mexico especially jarring. “The tariffs would really hit the automobile industry hard,” explained one analyst from the Peterson Institute for International Economics. “Parts will cross the border seven to eight times before final assembly, and the tariffs are applied every time a part crosses – so costs would go up very quickly,” the analyst noted.

Not surprisingly, the automotive industry, including parts and supplies, has consistently appeared on lists of “most affected industries,” should the tariff increases take effect. CNBC cited concern the tariffs could cause a strain to Canada’s automotive industry. And Bloomberg, Reuters, the Wall Street Journal, and the Financial Post were among outlets that put the industry on their list of most impacted by tariffs if they are imposed.

While the threat is real and the fallout potentially significant, there are things aftermarket businesses can do to improve efficiency and help offset the costs associated with higher tariffs. A few options include:

1. Shipment consolidation for improved transit time and reduced costs.

Auto parts shipments moving between the United States and Canada may benefit from a consolidation strategy in which smaller shipments are combined into a single, larger unit. The consolidated shipment qualifies for a reduced freight rate, and moves directly to the border, usually with no additional stops or layovers. Once at the border, the shipment clears customs as a single unit and avoids having to file paperwork for each part of the shipment.

Consolidation offers clear benefits including improved transit time, reduced freight costs, and a streamlined customs process. But, since the process requires multiple moving parts, not every logistics provider has the necessary resources to offer viable consolidation services that Purolator can offer. But given the potential advantages, it’s worth exploring whether a consolidation strategy would benefit your company.

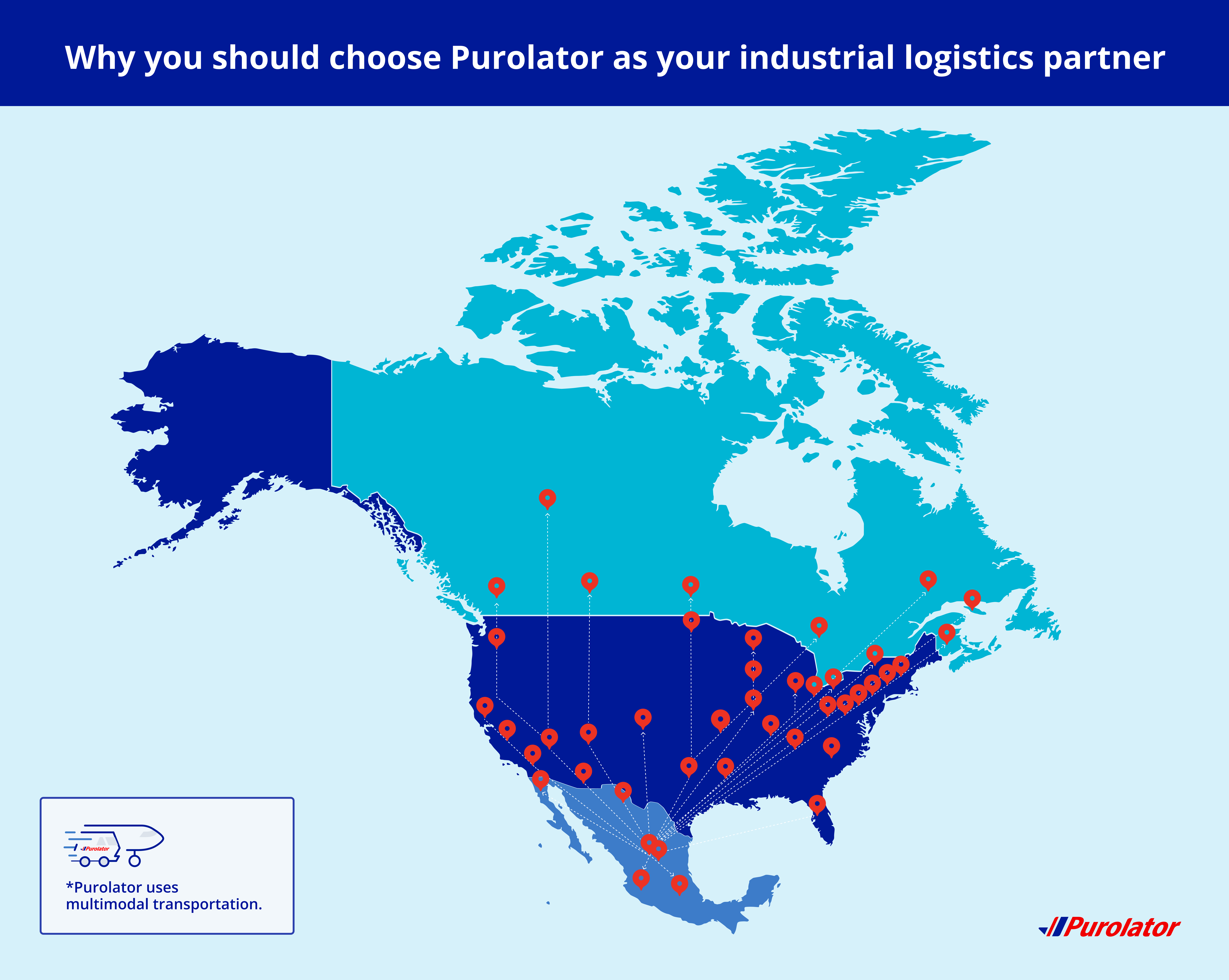

Purolator is a good example of a logistics provider that offers extensive consolidation capabilities for cross-border shipments. Purolator addresses aftermarket businesses’ need for speed and efficiency with capabilities that include:

- Customized U.S. pickups: Purolator works with each business to build an ideal solution. For a parts manufacturer or supplier this could mean strategically timed pickups, or a pickup that has both courier and freight shipments carried on the same truck. Shipments are combined with other Canada-bound shipments for fast, uninterrupted service to the Canadian border, and often arrive in Canada on the same day as their U.S. pickup.

- Seamless customs clearance: Purolator’s trade specialists ensure all customs documentation is pre-filed so that shipments clear customs with minimal delay.

- Comprehensive in-network service throughout Canada: Once in Canada, the consolidated shipment is broken down and enters Purolator’s Canadian network for final delivery. Important to note, Purolator is one of only a few transportation companies that offers coverage to all Canadian provinces and territories. Most companies limit service to a specific geographic region, which means shipments are farmed out to multiple carriers – often wasting valuable time, increasing the risk of damage, and adding costs.

Instead, Purolator offers guaranteed in-network coverage for fast, on-time deliveries to retail stores, repair facilities, suppliers’ distribution centers, dealerships, or direct to consumers’ homes.

2. Shared services for OEM and aftermarket parts.

With many manufacturers producing both OEM and aftermarket parts, the realization has set in that combining shipments for transport via the same truck makes sense both economically and to boost efficiency. This is especially true for OEM and aftermarket parts leaving the same manufacturing facility and headed for the Canadian market. Whereas in the past, manufacturers and suppliers were careful to maintain separate logistics plans for their OEM and aftermarket parts, smarter thinking has taken hold, and businesses are embracing comprehensive solutions.

3. Rethinking inventory management.

Aftermarket businesses depend on fast, reliable access to parts and supplies. But with an inventory that includes more than 10 million SKUs, a business must be selective in determining which parts to keep in stock, which to store in a warehouse or distribution facility, and which can be accessed from a distributor. Ideally, a business will reserve shelf space for most-needed products and have confidence that less-requested items can be quickly retrieved. The issue becomes a bit tricker though, for businesses moving between the U.S. and Canada.

Innovative solutions are helping to address this need, with options that include:

- U.S. based distribution. U.S. aftermarket businesses may be able to fulfill Canadian market needs from U.S.-based distribution centers without having to sacrifice speed or efficiency. This allows businesses to avoid having to invest in Canadian DCs and the added expense and burden of managing separate inventories.

- Integrated SKU management. Businesses can rely on an experienced logistics partner to help manage inventory across all facilities. This includes real-time visibility into all warehouses, distribution centers, retail spaces and repair centers. The logistics provider helps ensure that in-demand parts are continually replenished, with less-requested parts easily located and available for transport.

- Warehouse management. An established logistics provider may offer warehouse and fulfillment space to accommodate an aftermarket business’s changing needs. This can be especially helpful for aftermarket businesses engaged in e-commerce sales that need to source inventory close to end customers. By relying on a logistics provider’s facilities, an aftermarket business can accommodate what may be a temporary need for storage space without having to incur the expense of a long-term contract.

- Direct Ship Vendor (DSV) fulfillment. In some instances, it may make sense to ship products directly from a manufacturer to the end customer, effectively bypassing a distributor or retailer. For aftermarket businesses, a DSV solution could be a way to help do-it-yourself (DIY) consumers quickly access hard-to-find replacement parts for their older-model vehicles. Such an approach also makes sense for purchases of large or bulky products such as high-performance tires, or cargo carriers.

Direct-to-consumer fulfillment models can offer significant benefits which include:

-

- Reduced inventory and warehouse costs. Since the vendor maintains ownership of products, a retailer can significantly reduce inventory and associated warehousing costs.

- Ability to increase SKU listings. Aftermarket businesses can expand online product offerings without having to maintain inventory. A retailer can add items simply by listing them on its website and linking to the appropriate vendor. This allows the business to offer customers direct access to a wide parts selection but without the expense and hassle of having to physically take possession and store those products.

- Faster deliveries to consumers. Products move directly from the vendor/supplier to their end destination, which usually eliminates a stopover at a retailer’s distribution centre. This accelerates the fulfillment process, which can be especially beneficial for U.S. shipments headed to aftermarket businesses across Canada.

Tariff/Duty Management – Don’t pay more than you owe!

Regardless of the outcome of the current trade dispute, it’s never a good idea for a business to pay more in customs duties than is legally owed. An alarming number of businesses have learned this the hard way. International consulting firm Ernst & Young, in fact, reports that among their European business clients, nine out of ten pay more in duties than they actually owe.

A product’s duty assessment is determined based on the tariff classification code that is assigned during the customs clearance process. Every shipment crossing an international border is assigned a classification code as a way to (a) identify the product; (b) determine the applicable rate of duty; (c) identify eligibility for favourable trade benefits; (d) flag any restrictions on imports/exports of that product; and (e) identify the need for additional government agency approvals.

As this list makes clear, there’s a lot at stake in choosing the correct tariff classification code. But the process can be quite confusing, and mistakes happen.

For shipments entering the United States, codes are selected from a listing called the Harmonized Tariff Schedule. In Canada, the listing is called the Canadian Customs Tariff. Each requires a thorough understanding of a product’s components and manufacturing process. Whether a sweater was hand-knit or machine-knit, for example, is an important differentiator. Subtle differences like this could result in an incorrect code assignment and an overpayment of duties.

Product valuation is another data point that can affect customs payments. Since tariffs are assessed as a percentage of a product’s value, it follows that higher-cost items will pay more in tariff than lower-cost products. But, the rules are quite specific for determining a product’s value. Therefore, it’s in a business’s interest to double-check the accuracy of the value listed on customs documentation.

Many businesses have been able to reduce their tariff obligations by ensuring the accuracy of their customs documentation. This is a good “best practice” to incorporate for all cross-border shipments, but especially so during the current heightened trade environment.

While aftermarket businesses have little control over the outcome of current trade discussions, they can have a direct role in ensuring the efficiency of their cross-border logistics strategies. As the solutions discussed above make clear, businesses have options when it comes to cross-border shipping and opportunities for reducing costs without sacrificing service.

These options are detailed in our whitepaper, Logistics Efficiency within North America’s Integrated Auto Aftermarket Industry. Or if you’d like to learn more about our options for a personalized approach, reach out to me and we can discuss your strategy.